What we will discuss today is called Cashflow Statement. Through this, we can basically know how much cash an organization has received at a certain time and how much cash has gone out. Through this cash flow statement, we will get to know these things, and now we will discuss how it is prepared.

There are three activities in a cash flow statement

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

We need to add all balances of these three activities, and after that, we'll get a net change in cash. If we add the beginning cash balance with it, that will give the ending cash balance.

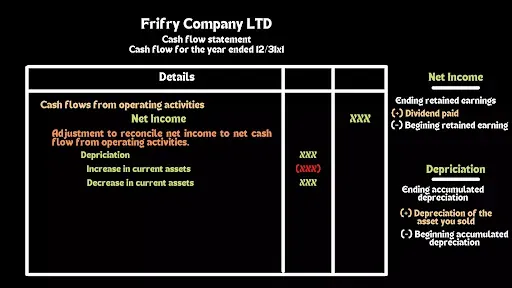

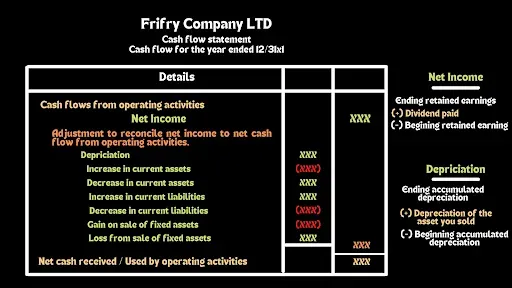

Cash flow from operating activities

To calculate cash flow from operating activities we first need the net income of the business. You will find net income in the Statement of Comprehensive Income, in your question. If you don't see any net income figure in the income statement, then you can figure that out by taking, ending retained earnings, and adding the dividend paid to it after that deducting beginning retained earnings. This will give you the net income for the period.

Under this heading, you'll find the four most common adjustments. If you are calculating the operating section you must look for these items first. The first one is depreciation. You have to calculate this item by taking the ending accumulated depreciation and adding the depreciation of the asset you sold in this accounting period. then deduct the beginning accumulated depreciation.

After that, the second thing is an increase or decrease in the current asset. Current assets are the assets that are expected to be converted to cash within a year. So accounts receivable, inventories, and supplies all are examples of current assets. If the current asset increases you need to deduct that figure. If the current asset decreases then you need to add the number as an adjustment.

The third item is the increase or decrease in current liabilities. If current liabilities increases you must add the number, and if current liabilities decrease you need to deduct the number.

The fourth and last item in the operating activities is profit or loss on the sale of fixed assets. If you make a loss after selling a fixed asset then you have to add that here. If you gain from selling a fixed asset then you should deduct that.

Now add all the adjustments and write the balance in the net income column. Now after deducting the adjustment balance from net income, you will find net cash received or, Net cash used by operating activities. If the balance is positive we will call it Net cash provided from operating activities, and if it is negative then that will be Net cash used by operating activities.

Cash flow from Investing Activity

Only three items will effect here. The first one is the purchase of a fixed asset. the second one is the sale of fixed assets. The third one is any long-term investment. You have to remember that, in investing activity, if cash comes in you need to add that number here, and if cash goes out then you have to deduct the number. By this, you will get a balance.

If the balance is negative, we will call that net cash used by investing activity. and if we get a positive balance then that will be net cash provided by investing activity.

Cash flow from financing activity

If any company issues shares that will come to this heading. If a company pays any bond or debenture or issues a bond or debenture, that will also affect here. Any long-term investment, and the dividend paid, will also be calculated under financing activity. You should remember these five items.

As we did before in the second step, here we will again add the numbers if cash comes, and if cash goes out we need to deduct the number.

After adding and deducting the numbers, if you find the balance is positive, that will call net cash provided by financing activities. If the balance is negative we will call that net cash used by financing activities.

After finishing the calculation of all three steps, we now got a balance called the net change in cash. If we add the beginning balance of cash from our balance sheet, we will get the ending cash balance. which should perfectly match the current year's cash balance in the balance sheet of your question.