What is 2/10 Net 30?

It's a term that tells that the person will get a 2% discount if they made a payment within 10 days. 2/10 net 30 is often used as a tread credit term if the customer pays the money within this period he/she will get a 2% discount and if not he/she must pay the full amount before 30 days.

Example of a Trade Credit

Company A is facing a downward trend in its sales, the CEO found that the key problem is that the company isn't giving any tread discount to its customer. For that reason, the company lags behind the competition. So it started to issue tread discount.

So now the customers need to settle down their payments before 30 days. If company A sells $10,000 of products to a customer with 2/10 net 30 terms, then the buyer must pay the full amount before 30 days and if the customers pay within 10 days they will get a 2% discount on payment. Then he needs to pay $9,800.

Journal Entries for Trade Credit

We can record discounts in two methods: 1# Net Method and the other one is #2 Gross Method.

If company A sells a product with 2/10 net 30 terms and the price is $1000, we'll be listing journal entries for tread credit in both Net and Gross methods.

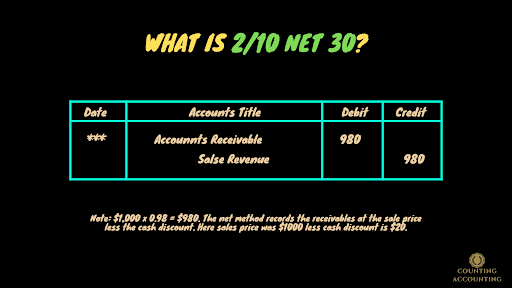

Net Method

Receivables are recorded at sales price, and if customers fail to pay the money during the discount period then the company needs to adjust the interest.

In the gross method account receivables are recorded in face value. If the customer pays before 10 days and gets the discount, the company should reduce the income statement balance.

If the customer pays after10 days:

Everyone loves to keep their money in their hands. By allowing tread credit a customer can get enough time to pay the cash. Also if they can make fast payments then they could get a discount on the payment. So it's a widely accepted way of boosting sales and generating revenue. Though there is a chance of creating bad debts.

Tags:

Financial Accounting