The three most frequently asked accounting interview questions.

One of the most frequently asked accounting interview questions is:

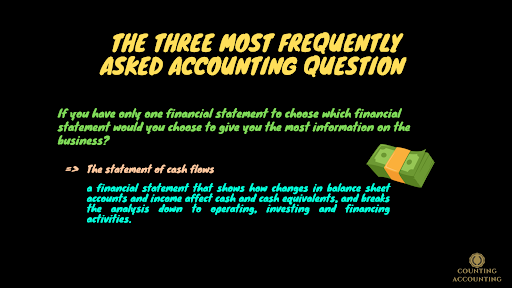

#1 If you have only one financial statement to choose which financial statement would you choose to give you the most information on the business?

I've heard this question many times before and I think the answer is the statement of cash flows. The reason is if you look at the P&L statement alone, you won't be able to tell what is the cash position or the debt the company carries. If you look at the balance sheet alone you can tell what the cash position is or what the debt position is but you can't tell anything about the actual health of the performance in terms of profit and loss. If you look at the statement of cash flows, it really has all the information you need because it begins with net income and then it goes on to detail cash from operating activities, and then it goes on to the section of cash from investing activities and then cash from financing activities.

So you can tell the P&L by looking at the net income on top. You can tell the ending cash by looking at the bottom of the sheets. You can tell the movement and the balance sheet accounts in the operating section. You can also look at the investing section and find out what the company is investing in, in terms of CAPEX. The financing section is going to tell you what debt the company raised, what debt the company has paid off, and also what interest was paid or received. So the cash flow statement is the answer to the most important financial statement.

#2 What is working capital and why it is negative?

Sometimes this question is tricky because when you think of working capital its what capital the equation is current assets minus current liabilities.

So the reason why it goes negative and it's not a bad thing rather it's actually a good thing when it goes negative, because it's a signal to the efficiency of the business. When working capital is negative, the formula of working capital equals current assets minus current liabilities. What goes into current assets? The cash, Accounts Receivable they are, and other liquid investments. What goes into current liabilities? Accounts Payable and other accrued expenses. When current liabilities are bigger than current assets, you have negative working capital.

It's signaling that you are collecting your Accounts Receivables faster than you are paying your Accounts Payable. Meaning your operation is efficient in the way that you are invoicing and collecting your cash fast and you are actually able to negotiate better terms with your vendors to push off these payments into the future and have higher accounts payable. So it's not necessarily a bad thing this is why you have negative working capital.

#3 What is the impact on income if your inventory goes up by ten dollars?

The answer to this is, that I think, that when you buy the inventory you are not impacting income at all. You're doing is you're dipping inventory ten dollars and crediting accounts payable or cash for ten dollars, that means zero impact on the P&L.

These are the most frequently asked accounting questions and accounting job interviews. If you think the article is useful to yours friends then please share it with them.

Tags:

Job Analysis