A mortgage is just a loan in which real estate is serving as the collateral for the loan. So you decide that you want to purchase a home, for example, and you put the home off the real estate as collateral to the lender. So who's the lender? Well, the lender could be a bank, it could be a credit union, and there are even some companies that basically they specialize in originating mortgages. So you've got this lender and you want to borrow the money to buy the home but you don't have the cash and they say, "Well, what do I do if you don't pay me back?" What recourse does this lender have as collateral? You say "I will give you the home as collateral for the loan." So if I don't make my payments you can come and take my home because it was serving as collateral for this loan. It's like security to the lender to make sure that you keep up with your payments on this property and it doesn't have to be home, it could also be a commercial building or something like that.

Example:

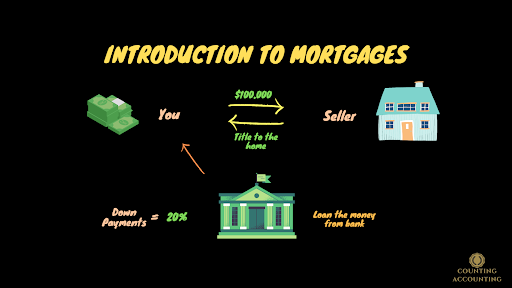

Let's say that you decide that you want to purchase a home and again it doesn't have to be a house but let's just say that you decide. So you are the buyer you're on the market for a home and then there is the seller and the seller says I'd like a hundred thousand dollars. So you don't have a hundred thousand dollars, so you go to a lender which is a bank. You say "Hey, I would like a hundred thousand dollars so that I can buy this house." The bank is going to look at things like your income, they look at your credit score, they're gonna evaluate how likely they think it is that you are going to make payments on this house to them. So assuming that they decide you're creditworthy. They're going to give you the cash and you have to give $100,000 cash to the seller. What you want to get back is you want to own the home and we'll call that that's the title to the home.

Down Payments:

When you go to the bank one thing to think about is that typically with a mortgage the bank is not gonna give you $100,000 cash even though that's what you need. You're gonna have what's called a down payment. Let's say that the down payment is going to be 20% of the home's value. Why wouldn't the bank just give you the $400,000? Why are they asking you for it for 20%? The thing is, what if the bank were to give you the hundred thousand dollars to buy the home and you never made a single payment? Well, then the bank has to do what's called foreclosing on the home (Get you out of the home and then they're gonna take that title). So they're gonna take title to the home and then they have to sell it. But it's a hundred thousand dollars home and they're gonna have to pay a broker to sell it, they're gonna have fees for that. It's not easy for them to sell this home it's not costless, and it's not free. So they're saying well you know what we don't want to give you the whole hundred thousand in case you never pay us we'll give you 80% and you pay the other 20% and that way if you never make a single payment they can foreclose and they're not going to lose their money.

So the bank is gonna give you cash, now it depends on what down payment you negotiate but let's say in this case of $80,000. Now you are taking some of your own money and the bank's money and giving it to the seller and then the seller is giving you title to the home. However, that title is subject to the mortgage. That means that you can't just turn around and sell it again or something because you have a mortgage on it. You have a lien on this property. You have to make all your payments to the bank before you own that home free and clear.

Mortgage Payment:

Now the bank gave you the $80,000 we got to give the bank something back, so you're gonna give the bank payments and that's called your mortgage payment. It's almost always a monthly payment. Your mortgage payment is going to consist of multiple parts. One part we'd have is the principal. The principal is the part where they loaned you the $80,000. All that has to be paid back but they're also gonna charge you interest. Now what interest rate you get depends on how creditworthy you are, depends on what the market rate of interest is at the time, how good you are at negotiating and what type of mortgage you select. So these are the main two components but those aren't the only things that are necessarily going to be in the mortgage payment might also have other things like for example the bank will force you to get homeowners insurance.