Mergers could be financed with securities cash or a combination thereof, and in this article, I'm going to show you examples of each of these different types of considerations being offered in an actually proposed merger. So let's start with

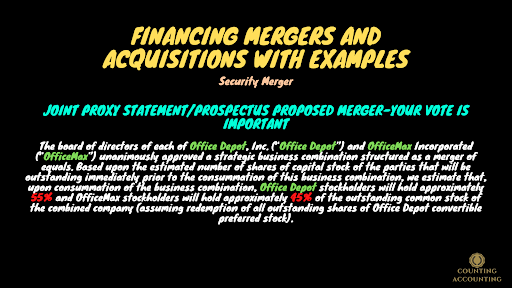

Securities: Office Depot and OfficeMax did a merger in 2013 and it was a (stock for stock) merger. There was no cash to change hands. What happened was they combined, and then they become one company and there's no more separate office max, it's just one company called Office Depot. And if you're a shareholder of office max, you no longer have shares of office max what you now have is 45% of the shares of the combined company. So you own shares in office max, office maxes no more. Now there's one combined firm and you as the office max shareholders jointly own the shares of Office Depot. That was stock for stock merger there was no cash changing hands, if you own shares and office max you didn't get any cash.

Cash for Stock: Now a different merger proposal in 2018 we have the company QAR industries they proposed to pay in cash 6.25 cents a share for this other company TSR, so this is an example of cash being offered to finance this takeover and there's no stock. When I say there's no stock, I mean QAR Industries is not offering any of its stock, they're just offering to pay cash to acquire TSR stock. With the example of Office Depot and OfficeMax, we had stock being offered in exchange for stock but now you're just gonna get $6.25 a share if this deal had gone through. If you're a TSR shareholder and you own one share you would have received $6.25, you wouldn't have received any stock in QAR or anything like that, so this is just purely a cash deal.

Cash & Stock for Stock: Now a final example is a combination that will have cash and stock being offered in exchange for stock of the target company. This involves Office Depot again but now this time Office Depot is the target. And the acquirer is the company staples. So staples wanted to acquire office depot the deal ended up getting blocked by the government but in any case, it's a good example of cash plus stock because what staples were offering was:

If you own shares an Office Depot, let's say you own one share you have got $7.25 per share in cash. So this is cash but that's not all you would have received, you would have received 0.2188 shares of staple's stock. For every share, you owned in office depot you were to receive 0.2188 shares of staples common stock plus $7.25 in cash.