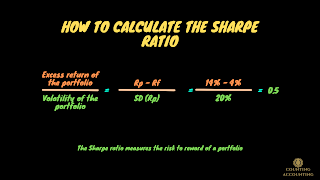

The Sharpe ratio measures the risk to reward of a portfolio. So the formula is we take the excess return of the portfolio which is the expected return of the portfolio (Rp) minus the risk-free rate of return (Rf) and we take that excess return and we divide it by the volatility of the portfolio. Remember volatility is a measure of total risk and we calculate it with the standard deviation of the expected returns of the portfolio (SD Rp). So excess return the portfolio divided by the volatility of the portfolio that gives us our Sharpe ratio.

Let's do a quick example, so if we have an expected return for the portfolio of 14% and then we see that the risk-free rate of return is 4% and we have the volatility of 20% for the portfolio. We just go and we just plug in our formula and we can very easily calculate the Sharpe ratio. So expected return of the portfolio is 14% minus a risk-free rate of 4% that will give us 10%. Now we'll divide 10% by 20% volatility. So we have a Sharpe ratio of 0.5.

What are the uses of the Sharp Ratio?

What do we do with this? We can use the Sharpe ratio to rank different portfolios. So, if you have two portfolios and one of them has a Sharpe ratio that's higher than the other you'll say "Oh I'm getting more reward per unit of volatility from the portfolio with the higher Sharpe ratio." So you've got this portfolio with the sharp ratio of 0.5 and then we've got another one that's 0.3. you're getting more reward per unit of risk from this portfolio that contains a higher sharp ratio than you are from this 0.3 portfolio. So in thinking of it as more bang for your buck in terms of reward or payoff for the risk that you're bearing.

How Sharp Ratio Works with Capital Market Line?

So we can compare portfolios, we can rank them for example if you've seen the capital market line let me just show you how it works with the capital market line. Let's say we had a portfolio where we're just thinking about two different stocks, we have stock A and then stock B and different combinations, different weights where we say 90% of stock A and 10% is in stock B. So we've got an x-axis that represents the volatility and the y-axis that represents the expected returns, we're just plotting all these different combinations in the purple part of the line. This purple part is the efficient frontier so these are efficient portfolios and then we have inefficient portfolios here in the yellow line. Check out my other articles on that if you don't quite understand where the efficient portfolio is I wrote an article on that.

But let's say we've got a risk-free return which is like 3% or something like that and then we draw a line. So we draw an upward slopping line that is just tangent to our previous line and this line is called this is the capital market line (CML). So this line is a combination not just going to allow in the portfolio to have stock A and stock B we'll also have some of the risk-free investment. So now you can have three different investments. These are all efficient portfolios that include some combination of the three of stock A, stock B, and risk-free investment.

Now here's where this comes back to the Sharpe ratio and why the Sharpe ratio is relevant. The point of tangency (right where the CML line intersects the efficient frontier) is just where the capital market line touches the efficient frontier. We call that the tangent portfolio. If all the assumptions of the capital asset pricing model are met, this tangent portfolio would also be the market portfolio that is the portfolio with the highest Sharpe ratio. So that is the one that investors would choose if they're rational they say "Hey, I'm getting the most reward per unit of risk if I choose this portfolio right here."

👉Excel Formate for Calculating Sharp Ratio👈

So there are a lot of different uses of the Sharpe ratio but if you're just going to remember one thing that it's a risk-adjusted measure. When we're looking at a portfolio and we're evaluating it we're saying how much reward are we getting per unit of risk for this portfolio. Then if we've got portfolio A, portfolio B, or portfolio C we can actually go and rank these portfolios based on their Sharpe ratio and the one with the highest Sharpe ratio is going to be the one that's giving you the biggest expected reward per unit of risk or volatility.