In this article, we're going to talk about how to use the payback method when the payback period is not an integer. For example, let's say it's 2.4 years or 2.7 years something like that so let's jump into an example let's say that

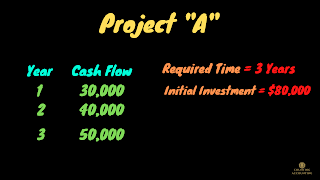

There's a firm that has a required payback period for this type of project of 3 years okay so if the project hasn't recouped its initial investment within 3 years then we're not going to accept that project right? So the initial investment for this project let's call it to project "A" is $80,000. So we're going to forecast the cash flows for project "A" and if we don't get at least $80,000 within 3 years if this project doesn't pay for itself that $80,000 within 3 years and if we can't break even then we're going to reject project "A".

So then the question is we have to calculate the payback period of this project how quickly does this project pay itself back? So we're going to look that in year 1 this project has a cash flow of $30,000 that we're receiving and then in year 2 it's $40,000 so we see that between year 1 and year2 we're receiving a total of $70,000. Now if you remember we put up $80,000, so the project hasn't quite paid for itself yet, we're still $10,000 short but when you look at year 3 we're receiving $50,000 and we were just $10,000 short, so we're definitely going to have this project pay itself back sometime during year 3.

But if somebody were to ask you what is the actual payback period? How quickly does this project pay itself back? We know that the answer is going to be somewhere between 2 and 3 years. The question is how do we calculate?

So we see that we are 10,000 short where it's coming into year 3. I got that by taking the 80,000 upfront invested minus the 70,000. We received it in the first 2 years, right? So let's look at this 50,000 we receive in year 3 what we're going to do is we're going to take the 10,000 which we need to break even as of year three 10,000 and divide it by the 50,000 that we receive in year three okay so that's going to give us 0.2

and so we're going to see that the actual payback period for this project is going to be 2.2 years. I got that by just saying look "we know it's going to take these 2 years right? and we know it's not going to take the full 3 years because we actually end up getting $120,000 if you add up all three years right?" So it's going to pay itself back sometime in this year 2 and when we're actually taking the ten thousand divided by fifty thousand. We're basically saying "Okay it's taking about one-fifth of the year" so you could even say two and one-fifth years right? That's equivalent to saying 2.2 so if somebody were to ask you like the manager says look how quickly does project pay itself back we would say 2.2 years.