Calculating the Forward Rate

In this article, we're going to talk about how you can calculate the forward rate based on yields from zero-coupon bonds. So when we say the forward rate what we're talking about is the interest rate that we could guarantee today, right now for a loaner investment that's going to occur at some point in the future could be two years from now, three years from now but we're going to lock in this rate today.

So in an example, we could say that the forward rate for year two for the second year would be the rate that you could get today, assuming that you wanted a one-year investment that was going to start one year from right now. So let's say we're at period zero and we're wanting to lock in an interest rate and this interest rate is going to be for a one-year investment that's going to go from year one to year two.

So right here in the year zero we're not going to have any investment but we're locking in the rate right now which is 6.1%, that'll be our rate for this period here. So at the end of one year from now which starts from point 1 and then it ends at the end of year two and we're locking in that rate today even though this investment or loan doesn't start until the year from now. So that's a forward rate and we just can denote it with an (f) and a subscript two to mean forward rate for year two.

Calculation of Forward Rate:

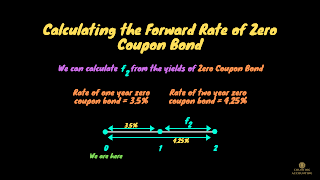

So let me put some numbers to it. We'll walk through it basically just make sure you understand conceptually though. So when we say that we know the rate for a one year zero coupon and the rate for two years zero-coupon what we're saying is if we know the yield for a one year zero coupon that's 3.5% but if you also instead bought a zero-coupon for two years for the whole two year period you get charged 4.25%. Now we know the whole thing is 4.25% we know the first part is 3.5% from the yields but we want to know the second part and that's the forward rate, right? This investment wouldn't start until year one and it would end when year two ends we want to know that rate and we can back it out so let's go about doing that.

So basically we can think about having two different strategies. One strategy would be to buy a zero-coupon bond for 3.5% a one-year zero-coupon and then simultaneously lock in a forward rate for year two. Now alternatively we could just buy a two year zero coupon right and that would be this strategy right here

that would be your return if you bought a two-year zero-coupon bond your return would be 1.0425 squared because we're just taking this 4.25% rate of return for those two periods. Now we know that these two strategies that the buying a one-year coupon and then locking into the forward rate for year two and then as opposed to just buying a zero-coupon for two years that those strategies should be equal in terms of what the return is because if they weren't then there'd be some kind of arbitrage opportunity. So really we're just looking at either way there's risk-free, right? These are should be kind of equivalent we're thinking about it's the same return because either way we're locking in the interest rates today.

So we can just go ahead and we can calculate this out and just solve and see what we get so we have 1.035 times the forward rate for year two it's going to be equal to 1.0868. So then we're going to have the forward rate for year two we just divide each side by this 1.035 and that's going to give us 1.05 again I'm just rounding here and then we can also just think of that as that's going to be a 5% return.

So what does that mean that means that the forward rate for year two is 5%. So if we bought a zero-coupon bond for one year and then entered into a forward rate for year two at 5% that would give us roughly the same return as just buying a two-year zero-coupon bond.

So that's for just looking at something with just two periods and you might say well how can we generalize this to multiple periods? What's really nice is we've got this formula

So the forward rate for any year, what I have this little (n) the subscript and that's the period that we're talking about. So like the forward rate for year two the forward rate for year three we can actually calculate that using this formula and we have YTM here which is yield to maturity that's just the yield on a zero-coupon bond.

So let's jump into an example and show how we would go about using this formula. So let's say that we have a set of yields here all are zero-coupon yields. We have a one-year zero-coupon a two-year zero-coupon three-year and so forth all the way to a five-year zero-coupon bond and we have these different yields here's, now we can use those yields to calculate the forward rates. Forward rate for year one is easy that's just the yield of maturity right now on the year zero so that's just going to be 4.1% that's just mechanical.

Now we want to say what about this forward rate for year two? So we want to know the forward rate for year two. Now what we're going to do is we're just going to use that formula. We have (1 + the yield) for period (n). What is period (n)? Well let's see here we've got a forward rate for year two so (n) is 2. So then we're going to have the 1 over the yield for a period (n), that's 3.8%. So (1 + 3.8%) is going to be 1.038 and we square that because of this we raise it to the nth power and again we're talking about period two here n = two so it's just 1.038 raised to the second power.

then in the denominator, we're going to have the yield from the previous year so you can see this (n-1). So well (n) is two because we're looking at the forward rate for period two so we just go and say the yield for the previous year is 4.1%. So we'll just add that 1 + the yield is going to be 1.041. Now we raise it to the (n-1) power but (n-1) it was (n) two so that we're raising it basically to the first power, we don't even need that there though obviously because you just raise anything to the first power it's just itself.

Now we can just go out in them of course we subtract 1 just like we do up in our formula. Now we can calculate this, and our forward rate for year two is going to be 1.035 which is 3.5%. I'm just saying that this 1.035 just means the equivalent of a 3.5% forward rate for year two.

Now similarly when we go to do forward rate for year three we're just going to say let's take the yield for year three. So that 4.3% and we just add 1 to it and then we raise it to the nth power and the (n) over here is going to be three. So we just take 1.043 we got this by just 1 + the yield raise it to the nth power which is three.

Then we divide it by the yield from the previous year, in this case (n-1). So it's (3-1) is 2. So the yield from year two was 3.8%. Now in the denominator, we have 1.038 and we raise that to the second power because we're raising it to the (n-1) power, and then, of course, we subtract 1 again.

So now we can go ahead and that will give us our yield and we're going to have 1.053 and then we can just think of that as 5.3%. Now I've actually calculated all the way through the fifth period here so I give you all the forward rates

and again here just n is going to be four and it's going to be five I'm not going to go through all these. I'm just going to give you the rates real quick in case you want to calculate these out for yourself. Now you might have noticed something already, this is kind of an interesting fact that we have here is when the yield (we're talking about this your coupon yield here) is greater than the previous year's yield when that's the case then the forward rate for (n) is going to be greater than the yield of the zero-coupon bond for period (n).

So in other words let's think about this since 4.3% is greater than 3.8% than the previous year's zero-coupon yield then that means that the forward rate for that period, in this case, Period three the forward rate for year three is going to be higher than the yield is so 5.3%. So because 4.3% is higher than the 3.8% from the previous year then the forward rate for that period three is actually going to be higher than the zero-coupon yield and that will always be true. Now the reverse is also true so if the yield is actually less than the previous year's yield in terms of zero-coupon yields then the forward rate for period (n) is actually going to be less than the yield of the zero-coupon bond for period (n).